Does A Car Need To Be Registered In Business Name In Order To Deduct For Tax

Epitome source: Getty Images

Business organization owners can accept a revenue enhancement deduction for the business use of their personal car. Follow the twists and turns of the machine revenue enhancement deduction with these five steps.

If you're a concern owner who hops in your personal car to meet clients or pick up supplies, you lot should be taking a tax write-off for the business apply of your car.

Can you deduct taxes for the business use of your automobile?

The self-employed can score a business revenue enhancement deduction for using their personal car for business. Tax deductions reduce your taxable income, lowering your revenue enhancement bill.

The car tax deduction comes in proportion to the business concern use of your motorcar. While you can and definitely should deduct a trip to visit a client site, the IRS is not handing out deductions for business owners driving their children to softball practice.

The deduction corporeality hinges on the vehicle blazon, purchase price, and its employ in the business. There are two methods to calculate the car tax deduction: the actual expense method and the standard mileage rate method.

How to authorize for business motorcar tax deductions

If you can put a check side by side to these three qualifications, you lot can deduct the concern apply of your personal car.

1. Yous're self-employed

Yous must be self-employed to deduct the business employ of your automobile. Before the Tax Cuts and Jobs Deed (TCJA), employees could also deduct some unreimbursed business expenses, including business organization mileage on their personal cars. Now, employees who use their cars for business concern travel rely on receiving mileage reimbursement from their employers.

I'm going to selection on S corps in this article, but information technology's zip personal. South corp owners who classify as employees tin't take a car tax write-off every bit a sole proprietor can. Instead, write a reimbursement bank check from your South corp to your individual banking concern account for the business concern employ of your personal machine. You lot tin can utilize either method when the car's title is in your proper name.

2. You or your business organization leases or owns the car

You tin can't deduct a machine you lot don't ain or lease. Make sure the automobile'due south title is in either your name or your concern's name.

Only put a car in your business'southward proper noun if you lot don't plan to use it for personal reasons, particularly if you're an S corp owner. Driving a business automobile for personal purposes counts as a taxable fringe benefit, potentially negating the car revenue enhancement deduction's benefit.

Further, when the motorcar is in your business's name, y'all can but employ the actual expense method to deduct motorcar expenses.

3. Business organisation driving is more than commuting

If the extent of your business driving is commuting between home and work, the IRS would argue that you don't really use your car for business. A regular commute between home and the office doesn't qualify as an eligible business concern trip.

You can just deduct your car'south business employ for driving between workplaces, from your role to a client's office, for example.

Nevertheless, those who work from a domicile part can count driving to some other workplace as business mileage. Don't forget to take a home office deduction, too.

How to take a tax deduction for the business apply of your automobile

Yous tin choose betwixt two methods for deducting the business organization use of your automobile. You lot'll face up restrictions if you switch methods, so choose wisely.

one. Decide the business use of your automobile

Assign a per centum for the personal and concern use of your car, based on mileage. To the IRS, commuting goes in the personal mileage bucket.

The best style to rails mileage during the twelvemonth is past using a mileage tracking app, such equally Freshbooks Mobile, or taking pictures of your odometer before and after a business organisation trip and recording mileage in a spreadsheet.

For example, Becky Business-Owner drove her leased Honda Civic 40,000 miles last year. She put in 30,000 business concern miles and 10,000 personal miles. Therefore, her motorcar is used 75% for concern and 25% for personal purposes.

two. Determine the standard mileage deduction

The standard mileage deduction formula is:

Standard Mileage Deduction = (Business mileage ✕ IRS standard mileage rate) + Not-Commuting Parking + Tolls

The IRS standard mileage rate changes annually. In 2020, information technology's $0.575.

Becky'south standard mileage deduction is $17,250 (30,000 business miles ✕ $0.575 IRS mileage charge per unit). She incurred no parking or toll expenses.

three. Determine the bodily expense method deduction

Next, tally the actual expenses of your vehicle for the twelvemonth. Include these costs:

- Gas

- Oil

- Repairs

- Tires

- Insurance

- Registration fees

- Licenses

- Depreciation or lease payments

- Parking unrelated to commuting

- Tolls

A note on depreciation and lease payments: Deduct depreciation for cars you own, and deduct lease payments for leased vehicles. You can deduct depreciation for cars financed through loans.

Depreciation throws a wrench in what would otherwise be a simple calculation. To calculate your car's depreciation, consult your taxation software or tax professional. What makes depreciation for cars complicated is the overwhelming number of depreciation methods and stipulations.

For instance, if the auto is used 50% or more than for business organization, you tin take an oversized depreciation deduction with the Section 179 deduction or bonus depreciation. Otherwise, depreciate your automobile using straight-line depreciation in proportion with its business utilize. Annual depreciation limits for cars depend on your motorcar's gross vehicle weight rating (GVWR).

Allow's become back to Becky, who leases her car. She incurred these expenses during the year.

| Particular | Total Expense | Business Percentage | Deductible Expense |

|---|---|---|---|

| Gas | $3,000 | 75% | $two,250 |

| Oil | $500 | 75% | $375 |

| Repairs | $500 | 75% | $375 |

| Tires | $800 | 75% | $600 |

| Insurance | $3,000 | 75% | $2,250 |

| Registration fees | $100 | 75% | $75 |

| Licenses | $0 | 75% | $0 |

| Lease payments | $three,000 | 75% | $two,250 |

| Total | $x,900 | 75% | $viii,175 |

Becky'south actual expense method deduction comes out to $8,175.

iv. Cull the method with the highest deduction

In Becky's case, she'd go for the standard mileage rate deduction because the $17,250 standard mileage rate method exceeds the $eight,175 bodily expense method.

If the numbers come out shut and you're unsure which method to use, go for the standard mileage rate. When you start out using the bodily expense method, yous can't switch to the mileage charge per unit. Yet, those who own their cars and starting time with the standard mileage rate can move at any time to the actual expense method.

Lessees can't change their method for the duration of the lease, so choose carefully.

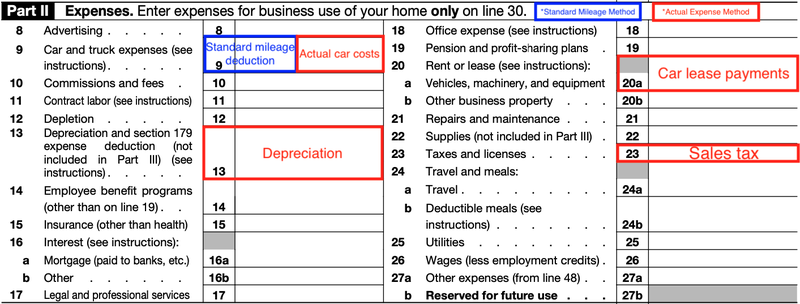

5. Take the machine tax deduction on Form 1040 Schedule C

Sole proprietors enter their automobile tax deduction on Schedule C. Follow the guide below for reporting your car's concern expenses co-ordinate to the method you chose.

Study the car revenue enhancement deduction on Grade 1040 Schedule C. Prototype source: Writer

FAQs

-

Y'all can write off your leased car payment when you choose the bodily expense method.

If you finance the machine, you tin't write off your monthly loan payment. Instead, accept a depreciation deduction for a portion of your automobile'due south value, up to the annual limit. Tax software or a tax professional can help you estimate the depreciation limit for your car.

-

This sounds like a joke, but it's not: Depending on your car's weight, you might authorize for a 100% revenue enhancement deduction for buying a car when it's used solely for business.

Cars with a GVWR between 6,001 and 13,999 pounds qualify for a 100% bonus depreciation deduction. In other words, buying a Cadillac Escalade for $fourscore,000 is 100% deductible in the year of purchase with bonus depreciation. About large SUVs authorize for the 100% deduction.

Lighter cars don't authorize for a 100% first-year deduction, but you may deduct a sizable portion of your new motorcar purchase with a Section 179 deduction, with annual limits on automobile and truck deductions.

Talk to a tax advisor earlier banking on deducting 100% of your car buy.

-

When yous apply the actual expense method, you tin can deduct repairs on line 9 on Schedule C. Don't study automobile repair costs on line 21, "repairs and maintenance."

In that location's vroom to save with a car revenue enhancement deduction

Deducting the business apply of your car equally a business organisation possessor doesn't have to be complicated. Keep runway of business trips taken in your personal car, and you tin can become a tax deduction.

Does A Car Need To Be Registered In Business Name In Order To Deduct For Tax,

Source: https://www.fool.com/the-ascent/small-business/articles/cars-tax-deduction/

Posted by: triggsshoothe.blogspot.com

0 Response to "Does A Car Need To Be Registered In Business Name In Order To Deduct For Tax"

Post a Comment